Police pensions FAQs

Please note, that where figures are provided, these are for illustrative purposes only, have been rounded, and are approximate, and no reliance should be placed upon them in any individual circumstances.

Section 1 (questions raised by members via our pay and morale survey)

1. I’ve just looked at my latest benefit statement for the pension accrued to date, why does my CARE 2015 Scheme pension seem so low in comparison to my pension under my earlier police pension scheme?

We believe this may cause undue concern, and is largely a function of the presentation of information differing between schemes. It is the result of a couple of factors. The main reason is due to how the CARE 2015 Scheme works in comparison to the earlier (1987 and 2006) final salary schemes. Under the CARE 2015 Scheme all accrued pension is subject to ongoing year on year increases, whereas accrual under the earlier schemes is based on your final pensionable earnings at the point of retirement. This inevitably makes the overall figures seem very different as it’s a fundamental difference in the way benefits accrue and are presented. For more details of how pension accrues under the CARE 2015 Scheme see FAQ number 2 below. Remember also that you have only been accruing pension under the CARE 2015 Scheme since April 2015 at the earliest and therefore the overall amount has not had time to build up.

2. So how does pension under the CARE 2015 Scheme build up?

During the first scheme year of your active membership you will accrue a block of pension which is 1/55.3 of your pensionable earnings in that scheme year. At the start of the second scheme year of your membership the block of pension accrued in the first scheme year will be increased by the percentage of the annual movement in the Consumer Prices Index (CPI) plus 1.25%. During that second scheme year of active membership you will also accrue a second block of pension based on 1/55.3 of your pensionable earnings during that second scheme year. At the end of the second scheme year the two blocks of pension will be added together and at the start of the third scheme year of your active membership the combined amount (of first and second year blocks) will be subject to an increase of CPI plus 1.25%. During that third year a further block of pension will be accrued and so on.

This process continues throughout your period of active membership of the CARE 2015 Scheme. So if you are a member for thirty years, you will accrue thirty blocks of pension which together will form your overall pension. The pension block you accrued in your first scheme year of active membership will have been increased annually thirty times by CPI plus 1.25% whereas the block of pension accrued in your thirtieth year of active membership will only be increased in this manner once.

So, for example, in the first year of active membership an officer working full-time earning £21,000 would accrue a pension block worth £379.75 per annum (i.e. 1/55.3 of £21,000). If that officer remained an active member of the CARE 2015 Scheme for thirty years before retiring and during that period the annual movement in the CPI remained at a constant 2%, then at retirement that block of pension will have become worth £991.28 per annum.

If you cease to be an active member of the CARE 2015 Scheme other than as a result of retirement then your combined blocks of pension accrual will continue to be increased annually until your retirement but by the movement in CPI only (i.e. not by CPI plus 1.25%).

3. Where can I get an idea of what pension I might receive from the police scheme(s) when I choose to retire?

By their nature benefits under a CARE scheme are more difficult to predict than those under final salary schemes due to the unpredictability of various factors like the movement in the CPI. Although most benefit statements provided by forces’ pensions administrators include some form of projection of benefits, for instance to normal pension age (age 60), this is limited and does not allow members to explore different possible scenarios, e.g. changing potential retirement dates.

Following pressure from the PFEW, the Home Office agreed to provide a pensions’ calculator for use by officers in England and Wales. Find out more and access the calculator here.

4. My change of membership from a final salary scheme to the CARE 2015 Scheme will mean I receive much lower benefits than I expected, won’t it?

Changes like this are never easy to digest, but it is very important to try and put things into context. Nobody is denying that the earlier final salary schemes provided excellent benefits. However, the CARE 2015 Scheme also provides a very good level of benefits. Under the CARE 2015 Scheme pension accrues at a rate of 1/55.3 for each year of membership as opposed to a rate of 1/70th under the final salary New Police Pension Scheme 2006 (NPPS 2006) or an initial rate of 1/60th under the final salary Police Pension Scheme 1987 (PPS 1987).

Although under the CARE 2015 Scheme accrual is not all based on ultimate final earnings at retirement as it is in the earlier schemes, as described in FAQ number 2 above, each year of accrual under the CARE 2015 Scheme is subject to annual increases in value. Therefore, although the final benefit arising from a CARE scheme is less easy to predict than that from a final salary scheme due to factors like future movements in the CPI, the likelihood is, that for a member who remains a constable throughout his or her career, and who reaches the top of the pay scale through incremental progression, the ultimate benefits (pension/cash) that would be derived from the NPPS 2006 and the CARE 2015 Scheme would not differ greatly. That is to say, the pension from a final salary scheme with accrual of 1/70ths of final pensionable pay for a Constable who spends 28 years of a 35 year career at the top of the scale, compared to the pension he or she would accrue based on 1/55.3 of his or her pensionable earnings each year revalued until retirement under the CARE Scheme, is not likely to be very different.

5. Is the treatment of all members under the CARE 2015 Scheme fair?

It is commonly accepted within the pensions’ industry that, due to their very nature, CARE schemes are fairer than final salary schemes because under them all members are treated in a more even handed manner. Unlike final salary schemes, CARE schemes do not unevenly favour those who progress through the ranks and earn more money at the end of their careers and who therefore have their whole pension based on that larger salary. Under a CARE scheme all members of whatever rank, whether full-time or part-time and regardless of future career progression, pay contributions and accrue pension based on what they are paid in the given scheme year.

6. Is my pension under the police schemes secure?

As demonstrated by the enactment of the Public Service Pensions Act 2013 leading to the introduction of the CARE 2015 Scheme, it is always possible for a government to pass primary legislation which changes things for the future. However, as part of the introduction of the new CARE 2015 Scheme, changes - some required by law and others additional (which PFEW helped to secure via the consultation process) - were also made to preserve and protect benefits that had already accrued in the earlier final salary schemes, e.g. the link to “final final” salary, timing of access to benefits and weighted accrual for former members of the PPS 1987. Even if, at some point in the future, changes are made in respect of future accrual, benefits accrued before the change will be protected.

In more general terms, the police schemes are sponsored and backed by the Government. Therefore, unlike many private sector schemes where the employer fails and the members lose some or all of their benefits, this would not happen to the police schemes as the Treasury guarantees the funding for the schemes. So, yes, your pension is as secure as it possibly can be.

7. Police pension scheme contributions are difficult to afford, why are they so high?

All of the police schemes provide pensions which can be accessed either unreduced or only subject to limited reduction, at an earlier age than under most other pension schemes. This recognises the nature of a career in policing. However, it also means that those benefits are likely to be payable for a longer period of time between retirement and death and are therefore valuable and expensive to provide/fund. This high value and cost is reflected in the contribution levels which members are asked to pay. That value and cost is also reflected in the contributions that your employer pays towards your benefits which is currently 21.3% of each member’s pensionable earnings.

Remember also that not only does the CARE 2015 Scheme have a high accrual rate of 1/55.3 and access to payment from age 55, it also provides generous benefits if you are required to retire early due to ill-health as well as generous survivor benefits should you die.

8. Does the pension I will receive from the CARE 2015 Scheme represent good value for the contributions I pay?

The best way in which to show the merit of joining the scheme early and continuing in membership is to give an example (albeit slightly simplified) of what you will receive for the contributions you pay.

Someone joining the force and the CARE 2015 Scheme at the age of 30 and earning an initial salary of £21,000 in his or her first year would pay contributions at the rate of 12.44% under Tier 1 which would total £2,612. As illustrated in the example given under FAQ number 2 above, the pension accrued in that first year will initially be worth £379.75 per annum.

If the officer continues as an active member for 30 years, and during that period CPI remains at a constant 2%, if he or she then retires at age 60 that first year of pension accrual will be paid to the member as £991.28 per annum within the overall pension.

If the officer then continues to receive his or her pension for the next 25 years before dying at age 85, and during that period CPI is assumed to have remained at a constant 2%, the amount of the pension the member will receive based on that £2,612 paid during his or her first year of membership alone will be approximately £31,750. This is over 12 times (more than 1200%) the amount of the original contribution.

9. How do police pensions, including the CARE scheme, compare to others?

Generally, within the UK, pension provision has been moving at an ever increasing pace away from final salary schemes towards money purchase schemes for the last two or three decades. Money purchase schemes are those under which member and employer contributions are invested until retirement and then the final amount is used to purchase benefits, however, there is no guaranteed level of benefit. In the private sector there are now virtually no final salary (or even CARE) schemes that are still open to new members and very few under which benefits are still accruing. In the context of this shift in provision in the private sector, the change to the provision for public service workers could be seen as inevitable. Remembering that under money purchase schemes it is the member alone who bears all of the investment risk connected to market fluctuations as well as the disadvantages of the poor state of the annuity market (an annuity is the insurance product usually purchased to secure money purchase scheme benefits on retirement), the switch for public service workers from final salary provision to a CARE scheme under which the risk is still borne by the sponsoring employer could rightly be viewed as a good deal compared to the potential alternatives.

Section 2 (general questions)

1. How did the new pension scheme come about?

In December 2011, Danny Alexander, the chief secretary to the Treasury as part of the coalition government, laid out plans to change public service pensions (link to speech), with the aim of saving money for the taxpayer. An increased cost of public service schemes to £32bn a year was behind the proposals, and they led the way to the introduction of the 2015 CARE Scheme.

2. What did the PFEW do to prevent the CARE pension scheme?

There was nothing the PFEW could do to prevent the scheme from being implemented. It was the only scheme proposed by the Government and was in line with the CARE schemes proposed for other public service workers. The Government is not required to negotiate with the PFEW on pension provision. It informed us of its proposal to introduce the scheme in 2012, as it needed a “long-term solution to the increasing costs of public service pensions that is fair to public servants and other taxpayers”.

We opposed its introduction and its application to existing officers, but it was introduced by the enactment of new primary legislation. The Government has the mandate to govern in the way it sees fit.

3. Why did the PFEW not challenge the Government?

The PFEW sought legal advice throughout the process and was advised that there were no grounds to successfully challenge the introduction of the new scheme. All avenues regarding the legality of overall scheme introduction have been considered, including public law (judicial review); European law, human rights and discrimination.

A group of police officers decided to put in a legal challenge to the transitional protections in the 2015 CARE scheme. The PFEW has not followed this course because we are aware of the potential detrimental risks and because we believe that transitional protections are a good thing, as we aim to achieve a positive outcome for as many of our members as possible.

4. Did you influence the scheme at all?

Yes. We ensured that:

- Officers have the ability to retire at 55 from the CARE scheme (with their pension actuarially reduced from age 60).

- There was an extension of those covered by full transitional protections and also those within four years of full protection received tapered protection, therefore avoiding a “cliff edge” scenario. This enabled more members to be covered than was the case in the Home Secretary’s initial proposal.

PFEW is in favour of transitional protections. Part of these protections have ensured that there is tapered protection for some of those officers in the previous pension schemes, to avoid a “cliff edge” of protection – by which officers could miss out on being able to remain in the old schemes by just one day of service or by being born just one day later. This allows those officers to benefit from continued membership of their earlier scheme for longer.

More than half of members were able to either have full protection or tapered protection, while previously accrued rights were also protected for all officers with Police Pension Scheme (PPS) 1987 and/or New Police Pension Scheme (NPPS) 2006 service.

Unprotected members and those with tapered protection who transfer to and remain members of the new scheme also benefit from the application of ‘final final’ salary in the calculation of their accrued pension and members who were in the PPS 1987 also benefit from weighted accrual.

5. What exactly did you do? Do you have a timeline?

We responded to the Home Secretary’s consultation, attended meetings and engaged in discussions to help influence the scheme to the benefit of our members. There is a timeline of events available here.

6. What does your original legal advice say?

We took legal advice on various aspects of the introduction of the new scheme. Go to our YouTube channel to watch former National Secretary Andy Fittes answer questions on our legal advice.

7. Why have you not published it? Who can see it?

We haven’t, and will not, publish the actual legal advice because it is subject to legal privilege. We have commissioned that advice so we don’t necessarily want other parties to see it – not because we have anything to hide but to try to prevent those working on behalf of other parties (i.e. other lawyers) being exposed to our position too early. This is standard practice and a common theme that public sector organisations and unions don’t publish their legal advice on public websites for instance.

However, the full legal advice is available for Federation reps to read at Federation HQ in Leatherhead.

8. Where can I find minutes/reports from pension meetings?

Minutes and reports from meetings can be found on the Research pages of The Hub, the internal website for the Federation and therefore only accessible by reps - therefore please contact your local rep if you wish to see these. As we work towards further transparency in the organisation we are looking at how and when such papers should be published online to be viewed.

9. How many colleagues are protected/partially or not protected?

In total, more than 67,000 of our 121,000 members had either full protection (more than 49,000) or tapered protection (just over 18,000).

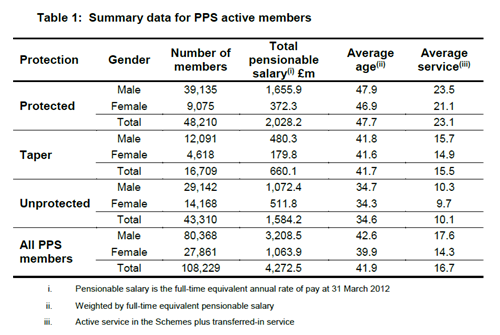

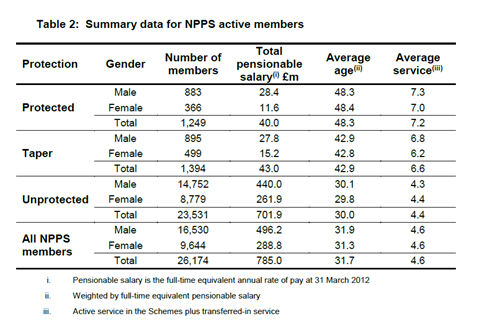

Figures around the number of officers who received full protection, tapered protection and no protection - as at March 2012 - can be found in a Government report here. Two tables are supplied below, although of course these figures will have changed since then.

10. How many members were affected, to a detrimental effect, by the pension changes introduced by this Government?

It is not possible to pinpoint this as not all of those officers in the new scheme will suffer an adverse effect to their future pension accrual. Some people in the new scheme might actually be better off.

11. How many members’ interests do you represent nationally?

Just over 119,000.

12. What about my specific pension? It is not just older members who had an expectation of pension pot. I joined at 19, partly for the pension, what are you doing to even out the loss?

We are not able to comment on individual pension cases.

There has been no loss of any accrued benefits. Those benefits accrued to the date of change have been protected, and because of the link to ‘final final’ salary and weighted accrual, are protected on a more generous basis than is strictly required by law.

What has been lost is the expectation that the old schemes would carry on indefinitely and unfortunately such an expectation is not capable of being protected.

The Government is empowered to pass primary legislation to change matters and this is what has happened here; PFEW was not in a position to stop it, nor are any other staff associations or unions.

The 2015 CARE scheme remains a very good pension scheme, and is favourable compared to most other pension schemes, both in the public sector and those in the private sector.

13. When calculating lump sums in the old 1987 scheme, why do female officers receive more per £100 commuted than their fellow male officers? Surely this is discrimination due to gender?

This isn’t correct. Men and women have the same commutation factors in the Police Pension Scheme 1987.

14. Do you have a pensions calculator for members to use?

Following continued lobbying by the PFEW Research and Policy Support department, the Home Office agreed to provide a police pension calculator for officers. The Home Office launched the calculator in March 2018. Read our guidance on how to access and use the pension calculator.

15. Why have a Federation, or why in fact pay into a pension scheme?

The Federation remains the single best way to protect your interests. Benefits include:

- Access to trained Federation reps. For example, in a misconduct hearing the only right of audience with the officer under investigation is a Fed rep or a friend, but only Fed reps are trained specifically in conduct regulations. Solicitors do not have a right to attend these meetings

- Assistance in misconduct or unsatisfactory performance and attendance cases

- Legal advice in pursuit of a civil claim for damages against a third person if you are injured on or off duty as a result of a third party’s negligence

- Legal assistance in Criminal Injury Compensation Claims and appeals

- Legal advice and assistance on any matter connected with your occupation, including discrimination claims

- Legal representation if you are accused, or charged with criminal or road traffic offences arising out of police duty

- Legal assistance to pursue a claim for defamation arising out of your duty as a police officer if the need arises

- Assistance in police pension appeals, or other matters of general principle

All police officers have the option to opt out of the pension scheme at any time, but it remains a good scheme and we strongly advise anyone to seek independent financial advice before doing so.

16. Where can I go to get more information?

If you have any questions about your individual pension provision, please contact your forces’ pensions’ administrator. Any pension issues arising should, in the first instance, be directed to your local Branch Board Secretary.